Personal finance management isn’t just about cutting costs — it’s about creating a smart financial strategy that helps you live stress-free today and build long-term security for the future. In this guide, we’ll explore essential tips for budgeting, saving, investing, debt management, and lifestyle money habits. We’ll also dive into how artificial intelligence is transforming personal finance in 2025, making money management smarter, faster, and more personalized than ever before.

Let’s dive in 🚀

Table of Contents

🔹 What is Personal Finance? (The Basics You Need to Know)

Personal finance management is simply how you handle your money — from spending and saving to investing and planning for the future. It’s not just about numbers; it’s about making smart choices today so you can enjoy peace of mind tomorrow.

👉 Think of it as your money roadmap:

- Income – your salary, side hustle, or business earnings 💼

- Expenses – rent, groceries, bills, and lifestyle spending 🏠

- Savings – your rainy-day fund and future goals 💰

- Investments – stocks, real estate, or retirement plans 📈

- Debt – managing loans, credit cards, and repayments 💳

💡 Pro Tip: Start by tracking where your money goes every month. This alone can improve your money habits dramatically. While AI-powered apps help us manage digital money, our physical money and cards still need smart organization. A reliable men’s wallet & ladies’ wallet is more than just an accessory—it keeps your cash, credit cards, and IDs safe, stylish, and accessible when you’re on the move. If you’re upgrading your money-management game, pairing your financial tools with a slim & durable wallet is a smart choice.

🔹 Budgeting & Saving Finance (Your Foundation to Wealth)

📝 Budgeting Finance for Beginners

If you’re just starting with budgeting, keep it simple! Begin by writing down your income vs. expenses and then set aside a portion for savings 💰. To make things easier, you can use Excel sheets or handy budgeting apps 📊.

📱 Best Budgeting Apps in 2025

Some of the most popular apps include YNAB (You Need A Budget) 🔄 – perfect for zero-based budgeting, Mint 💵 – an all-in-one expense tracker, Goodbudget ✉️ – based on the envelope budgeting method, and PocketGuard 🛡️ – the best choice for beginners.

✨ Using apps keeps your budget organized and improves money management skills.

🔄 Zero-Based Finance Budgeting

This method makes sure every dollar has a job 💵. You assign your entire income to expenses, savings, or debt payments until Income – Expenses = 0. It’s especially great for people who tend to overspend, as it creates accountability and ensures no money goes unnoticed ✅.

📊 50/30/20 Budget Rule

Another simple method is the 50/30/20 rule. Here’s how it works: 50% of your income goes to needs 🏠 (rent, food, bills), 30% is for wants 🎉 (travel, shopping, lifestyle), and 20% is dedicated to savings and investments 📈.

💡 This simple framework works for beginners!

💵 How to Save Money Fast

If you want to build savings quickly, start by cutting subscriptions you don’t really use 🚫📺. Choose to cook at home instead of eating out 🍳, and make sure to automate your savings by paying yourself first 💰. You can also use cashback cards wisely 💳 to get rewards on everyday purchases without overspending.

🎯 Saving Challenges for Finance

If you struggle to stay consistent with saving, try fun money challenges to keep yourself motivated. The 52-Week Challenge 📅 is simple — save $1 more each week (Week 1 = $1, Week 2 = $2, and so on) and by the end of the year, you’ll have over $1,300 saved 💵. Another popular one is the No-Spend Challenge 🚫🛍️, where you avoid non-essential spending for 30 days. It’s a great way to reset your habits and realize how much you can live without.

While AI is revolutionizing financial systems, it’s also making a massive impact in medicine—helping doctors with faster diagnosis, drug discovery, and even robotic surgeries. To explore how AI is improving healthcare outcomes, read our in-depth article on AI in Medicine.

🚨 Emergency Fund Tips

Always keep 3–6 months of expenses in a high-yield savings account 🏦. Life is unpredictable — from sudden medical bills to job loss — and having this safety net protects you from falling into debt traps 💳. Think of it as your financial shield that gives peace of mind and stability.

🔹 Investing & Wealth Building

📈 Investing Finance for Beginner

If you’ve never tried investing, it’s smart to start small. Go for index funds or ETFs 📊 instead of picking individual stocks. They’re generally safer, more diversified, and less stressful — making them perfect for beginners who want to grow wealth over time 💵.

💹 Stock Market Basics

When you buy stocks, you’re actually buying ownership in a company 🏢. Some companies share their profits with investors through dividends 💵, which means you earn money just for holding the stock. Others focus on growth stocks 🚀, which may not pay dividends but can build significant long-term wealth over time.

🛠️ Passive Income Ideas

If you want to grow wealth while you sleep 😴, there are several smart passive income ideas to explore. You can try affiliate marketing 🌐, where you earn commissions by promoting products. Invest in dividend-paying stocks 💵 to receive regular payouts from company profits. Consider rental property 🏠 for steady monthly income, or create digital products like courses 🎓 and eBooks 📚 that keep earning long after the work is done.

💡 Passive income helps you earn while you sleep. Just like finance, the health sector is being transformed by AI—from early disease detection to personalized treatment plans. If you’re curious about how artificial intelligence is reshaping healthcare, check out our detailed guide on AI Uses in Health.

💰 Dividend Investing

With dividend investing, you put your money into companies that pay regular dividends 💵 — big names like Coca-Cola or Apple. It’s a smart way to build long-term wealth, since you not only benefit from stock growth 📈 but also earn steady payouts along the way.

🏡 Real Estate Investing Tips

Real estate can be a powerful wealth-building tool. Start with a rental property 🏠, whether it’s a single apartment or even an Airbnb. Always research local markets 🔍 before buying to understand demand and pricing, and remember to leverage mortgages wisely 💳 so you don’t overextend financially.

🎯 FIRE Movement (Financial Independence Retire Early)

The FIRE movement encourages aggressive saving + investing so you can retire early. People save 50–70% of their income to reach financial independence fast.

🔹Finance Debt & Credit Management

⚡ How to Pay Off Debt Fast

When it comes to crushing debt, two popular methods can help you stay on track. The Snowball Method ⛄ focuses on paying off your smallest debt first, which gives you quick wins and keeps you motivated. On the other hand, the Avalanche Method 🏔️ targets the highest-interest debt first, saving you the most money in the long run. Both strategies work — the best one is the method you’ll actually stick with 💪.

🎓 Student Loan Repayment Strategies

Paying off student loans can feel overwhelming, but a few smart strategies can make it easier. You can refinance to get a lower interest rate 💰, or take advantage of government repayment programs 🏛️ designed to ease the burden. Whenever possible, try making extra payments 📈 — even small amounts can help you pay off debt faster and save money on interest in the long run.

Beyond money management, AI is also redefining education with personalized learning, smart tutoring systems, and automated grading. If you want to dive deeper into how AI is shaping the future of classrooms, read our blog on AI in Education.

💳 Best Credit Cards for Beginners

Using the right credit card can actually work in your favor. Look for cards with a low annual fee 💵 so you’re not overspending just to keep it. Many cards offer cashback rewards 🎁 on everyday purchases, helping you save while you spend. Plus, responsible use helps build your credit score 📈 — which is key for getting loans, mortgages, or better interest rates in the future.

🌟 How to Improve Credit Score

A strong credit score makes life easier when applying for loans, renting an apartment, or even landing certain jobs. To boost yours, always pay bills on time ⏰, keep your credit utilization below 30% 💳, and avoid closing old accounts 🗂️ since they help build a longer credit history. These small habits add up to big financial benefits over time.

🔹 Lifestyle & Money

👨👩👧 Money Saving Finance Tips for Families

Managing money as a family can feel challenging, but a few smart strategies make it easier. Start with meal planning 🍲 to cut down on food waste and reduce grocery bills. Use a family budget calendar 📅 to track income, expenses, and upcoming payments together. And don’t forget to buy essentials in bulk 🛒 — it saves money in the long run and keeps your household stocked. AI isn’t limited to complex industries like banking or trading—it’s already a big part of our everyday life, from smart assistants to personalized shopping and even traffic management. To see how AI is making day-to-day living smarter, explore AI Use in Daily Life.

🎓 Money Tips for Students

Building good financial habits early can set you up for long-term success. Always avoid credit card debt 💳❌ by spending only what you can pay off in full. Take advantage of student discounts 🎟️ on software, food, and travel to stretch your budget further. And most importantly, start a small savings habit early 💵 — even setting aside a few dollars each week can grow into a strong financial cushion over time.

❤️ Financial Planning for Couples

Managing finances as a couple works best when there’s open communication 🗣️. Always share your financial goals openly — whether it’s saving for a wedding, buying a home, or planning for kids. Consider having both joint and individual accounts 🏦 so you can balance shared responsibilities with personal freedom. And don’t forget to plan ahead for big milestones like marriage, a house, or children 👶 — it keeps you financially prepared for the future.

Technology and finance may be evolving rapidly, but taking care of yourself is just as important. With the hot season approaching, your skin needs extra protection and hydration. Don’t miss our complete guide on Summer Skincare – Ultimate Glow Guide for Skin (All Types)

💡 Side Hustle Ideas

Looking to earn extra cash? Try freelancing online 💻 in areas like writing, design, or coding. If you enjoy being creative, consider content creation 🎥 through YouTube, TikTok, or blogging. Another option is working as a virtual assistant 📧 to help businesses with admin tasks. And for long-term income, you can sell digital products like eBooks, templates, or courses 📚 — a great way to make money while you sleep.

🌍 Best Ways to Make Money Online

In today’s digital world, there are endless ways to earn money beyond a 9–5. You can start blogging or a YouTube channel 🎥 to share knowledge and earn through ads or sponsorships. Launch a print-on-demand store 👕 to sell custom designs without holding inventory. Explore affiliate marketing 🌐 to earn commissions by recommending products. Or, if you have the right skills, apply for remote jobs in finance or IT 💻 — offering flexibility and solid pay.

| Feature | Traditional Finance Management 🏦 | AI-Powered Finance Management 🤖 |

|---|---|---|

| Budgeting | Manual tracking via spreadsheets or pen & paper ✏️ | Automated tracking with AI apps 📊, real-time alerts 🔔 |

| Investment Decisions | Based on personal research or financial advisor advice 📚 | AI algorithms analyze market trends & predict opportunities 📈 |

| Fraud Detection | Relies on bank monitoring & customer reports ⚠️ | AI detects anomalies instantly and prevents fraud 🚨 |

| Expense Analysis | Time-consuming, prone to human error ⏳ | AI automatically categorizes & provides insights 💡 |

| Personalization | Generic advice, one-size-fits-all 💬 | Tailored recommendations based on user behavior & goals 🧠 |

| Time Efficiency | Requires manual effort, frequent check-ins ⌛ | Fully automated, 24/7 monitoring & suggestions ⏱️ |

| Decision Speed | Slower, reactive decisions 🐢 | Fast, predictive, data-driven decisions ⚡ |

🔹 AI in Finance (The Future of Money 💡🤖)

AI is revolutionizing finance — from personal finance apps to stock market predictions.

🤖 AI in Modern Finance

AI is truly revolutionizing finance — from personal finance apps that help you budget smarter to stock market predictions that guide investors 📈. Some real-world examples include Robo-Advisors like Wealthfront and Betterment 🧠, which offer automated investing tailored to your goals. In banking, AI powers fraud detection systems 💳 (used by Mastercard and Visa) to keep your transactions safe. Plus, many banking apps now use AI chatbots 💬, giving customers 24/7 support without the wait.

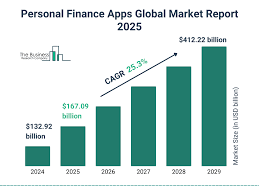

📊 AI in Finance Jobs & Market

The rise of AI in finance has opened up exciting new career paths. Companies now need AI data analysts 📊 to interpret financial trends and insights. In risk management, professionals use AI tools ⚡ to detect threats and prevent losses faster than ever. And with the growth of AI-powered financial advisors 🤖, there’s a demand for experts who can design, manage, and optimize these smart systems — blending tech with money management.

🎓 AI in Finance Training & Courses

If you’re interested in building a career at the intersection of finance and AI, there are great learning resources to get started. Platforms like Coursera 🎯 offer an AI in Finance specialization, while edX 📚 provides courses on FinTech and AI. Even the CFA Institute 🏦 has introduced AI-focused modules to help finance professionals stay ahead of the curve. These programs can give you the skills and certifications needed to stand out in this fast-growing field.

It’s discussing market strategies, analyzing AI-driven insights, or holding investor presentations, having a high-quality video conferencing setup is essential. A UVC-compliant HD camera with built-in dual microphones ensures crystal-clear video and audio, making financial discussions more productive and professional. Plus, with Windows Hello facial recognition support, this device doesn’t just enhance communication—it also boosts security, an important factor in today’s AI-driven finance world where data protection is a priority.

👉 If you’re looking for a reliable solution for your online finance meetings, check out this HD teleconferencing camera here.

🔮 Future Role of AI in Finance

AI is set to make money management smarter than ever. Imagine having a personalized financial assistant 🤖 that helps you plan, save, and invest based on your unique goals. AI-powered tax planning 🧾 will simplify filing and help you maximize deductions, while smarter credit risk assessment 📊 ensures fairer lending decisions. On top of that, fully automated budgeting apps 📱 will track your spending in real time and adjust your budget instantly — making personal finance almost effortless.

🔹 High-Intent SEO Topics (2025)

💵 How to Save $10,000 in a Year

Saving a big amount might sound intimidating, but breaking it down makes it easier. To reach $10,000 in a year, you’ll need to put aside about $833 per month or just $27 per day 📅. Start by cutting luxury expenses 🚫👜 like dining out or unnecessary subscriptions, and then boost your income with side hustles 💻 — whether freelancing, content creation, or selling digital products. With discipline and consistency, hitting that savings goal is totally achievable ✅.

💻 Best Side Hustles to Make $1000 a Month

Looking to boost your income? Several side hustles can realistically earn you an extra $1,000 per month 💵. Try freelancing ✍️💻 in areas like writing, coding, or graphic design. Dive into affiliate marketing 🌐 to earn commissions by promoting products online. Share your knowledge through online tutoring 🎓, or explore e-commerce 🛒 by selling products on platforms like Etsy, Amazon, or Shopify. With dedication, these side hustles can become steady income streams.

🕒 How to Retire Early at 40

If your goal is to achieve financial independence, you’ll need to take bold steps. Start by practicing aggressive saving 💰 — putting away 50–70% of your income. Grow your wealth by investing in stocks and real estate 📈🏡, and always make it a habit to live below your means 🚫💸. These strategies may require sacrifice in the short term, but they set you up for long-term freedom and security.

🎯 Conclusion

Managing personal finance is not about being perfect — it’s about being consistent. Whether you’re budgeting for the first time, paying off debt, or exploring how AI is shaping finance, remember: your financial future depends on the habits you build today.

🔥 Start small → Stay consistent → Build wealth → Achieve financial freedom!

FAQS

What is personal finance?

Personal finance is managing your income, expenses, savings, and investments to achieve financial goals.

What is AI in personal finance?

AI in finance uses technology to help with budgeting, tracking expenses, and making smarter investment decisions.

How can beginners start managing money?

Start by setting a budget, tracking spending, saving a small amount regularly, and using simple finance apps.

How can AI improve budgeting and saving?

AI can automatically categorize spending, send alerts for overspending, and suggest optimized saving plans.

What are some popular AI tools for finance in 2025?

Tools include Robo-Advisors like Wealthfront/Betterment, AI-powered budgeting apps like PocketGuard, and banking chatbots.

How do I combine traditional finance methods with AI tools?

Use AI for automation and insights while keeping manual tracking or consulting a financial advisor for complex decisions.

How does AI predict stock market trends?

AI analyzes historical data, market indicators, and global events to forecast potential stock movements using algorithms and machine learning.

Can AI replace financial advisors completely?

While AI provides data-driven insights and automation, human advisors are still essential for personalized planning, risk management, and complex strategies.

How does AI enhance risk management in finance?

AI detects fraud, monitors credit risk, evaluates investment risks, and identifies

anomalies in real-time to prevent losses.

“📝 What’s your #1 budgeting tip for 2025? Comment and let us know!”

Leave a Reply